Oregon Agricultural Overtime Pay Credit

ByWhat is it?

House Bill 4002 was enacted on June 3, 2022, which requires overtime pay for agricultural workers. This bill will affect all aspects of the agricultural industry, from crops, dairies and livestock to delivery and storage of agricultural products (NAICS codes 111 or 112) starting January 1, 2023. The Senate also attached (SB) Bill 1524 (2022) with a provision that a three-year net operating loss carryback is allowed.

Ultimately the overtime hours limit will be phased down to 40 hours over the next five years. Overtime pay starts with hours worked beyond:

- 55 hours in a workweek for calendar years 2023 and 2024.

- 48 hours in a workweek for calendar years 2025 and 2026.

- 40 hours in a workweek for calendar year 2027 and thereafter.

There are certain classes of employees that will not be subject to the new overtime rules such as:

- Small farm exception for piece-rate hand harvesters and pruning laborers,

- Commuter hand harvesters,

- Minor hand harvesters,

- Certain family members,

- Ranchers depending on compensation structure and how much of their time is spent in the range production of livestock, and

- Salaried administrative employees that meet specific requirements.

Employers should consult with their tax advisor or legal counsel when seeking to apply an exemption for employees. A misclassification could result in penalties that add up quickly.

Tax credit eligibility

The Oregon Department of Revenue will be administering the refundable tax credit program with an application process and tax forms. The Department will accept applications and determine how much credit each applicant is allowed to claim. There is an allotted annual cap of $55 million of total credits available for distribution. If there are more than $55 million of credits requested, the Oregon Department of Revenue will be responsible for the apportionment criteria.

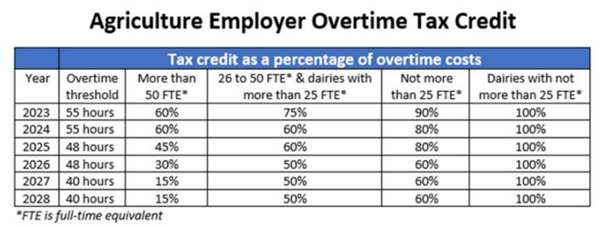

The tax credit on the business Oregon Tax Returns, for the work performed in Oregon by an eligible hourly agriculture employee, will act as a source of financial assistance to employers. There will be multiple levels and phase outs for this credit depending on the agricultural industry your business is in and your number of full-time employees. Full-time employees are defined in the bill as one or multiple employees having worked 2080 hours in a calendar year. See the chart for the breakdown of the phase out of the credits based on your full-time equivalents (FTEs). Please note there are different phase outs for dairies that are noted in the chart.

Source: Oregon Department of Revenue- July 2022 newsletter

Deadline to apply for tax credit

In order to be considered for the credit, there will be an application to complete through the department of revenue that will be due by January 31 following the year the credit is to be claimed. Employers will apply for the credit beginning in January 2024. This application will include providing documentation of the overtime hours for which you are seeking credit.

Businesses taking advantage of the credit should be prepared to extend not only their business returns, but also any related business and personal returns. The extension will be necessary as the notification of the tax credit awarded may not be available by the original due date of the returns. Notifications are expected to be sent by June 1, 2024. Applicants filing for the credit will automatically be granted an Oregon tax filing extension which extends the due date to October 15.

Applying for tax credits

The Oregon Department of Revenue is expecting to create an application process, both in paper and online, through Revenue Online during 2023. For the first year of applications, the Oregon Department of Revenue plans to provide a letter to all qualifying applicants by June 1, 2024 with the maximum amount of credit they are awarded Additionally, denial letters for the credit will be mailed by February 15, 2024; they are still determining the appeals process for credits that are denied.

As an agricultural business, what can you do now to plan? Documentation will be your best tool going into this new application process in 2024. If you do not already have a way to track your weekly hours by employee as 2023 gets underway, work with your team to create an efficient and proactive way to record your payroll hours to ensure you are not only paying your workers correctly under the new rules, but also providing documentation during the application process.

If you have questions, contact our agribusiness team.