What inspires you?

Here at Kernutt Stokes, we dream big, chase fresh ideas, and constantly explore new realms. Every day we challenge our employees to develop their leadership skills, improve their technical know-how, and learn to observe from new perspectives.

We understand that you have many options open to you when it comes to establishing your career. Are you ready for a challenge? Are you ready to carve your own path to success? Do you want to work for a company that was named one of the 100 Best Companies to Work For in Oregon? Then Kernutt Stokes might just be the place for you.

We know you have lots of options to choose from when you graduate college.

As a mid-sized firm, we invest in our people and provide you with the time to find what you love when it comes to tax and audit. Our partners know you by name, you get to connect with the clients, have fun opportunities to socialize with your coworkers, all while enjoying life balance. Live a KS life with us!

Kernutt Stokes is a master of the “work hard, play hard” mentality. You’ll work long hours when it’s needed, but you’ll be rewarded for your time and effort.

Our firm offers flexible schedules and comp time. We recognize the extra time and effort our team members put in during our busy season. To that end, you can bank your overtime hours to be used at a later time in the year. The comp time may give you the perfect opportunity for an extended trip to visit relatives to backpack through Europe or spend time with family.

Looking for an internship that actually prepares you for public accounting? You’ll find exactly that at Kernutt Stokes. Plus our internship program is FUN with lots of time to connect with staff over lunch and social activities outside of the office, allowing you to get to know our unique firm and people!

We offer two internship programs, one in the winter/spring, and one in the summer. Our winter internship provides flexible scheduling to work around your class schedule, no travel, and a great working environment. This is an excellent introduction into tax for juniors who have not yet taken a tax class or for seniors who want to get hands-on application of the tax they have learned from class. During our summer internship, you’ll get hands-on experience working through the audit process on real clients, including the opportunity to conduct the audit from beginning to end with real-time training/ coaching from managers and experienced staff.

Our Recruiting Team

You can find our Recruiting Team on college campuses and at recruiting events across the state. Led by Christina Newland, our director of talent acquisition, you have the chance to meet with a wide range of our staff, including interns, experienced associates, managers, and partners. We look forward to talking with you!

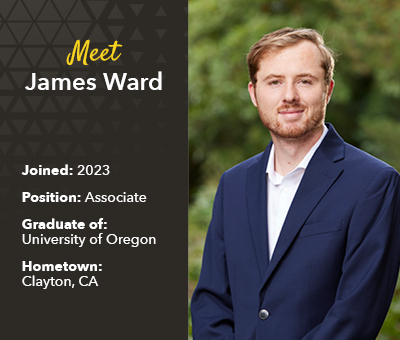

Employee & Intern Spotlights

Information and Resources

Kernutt Stokes Establishes Scholarship Fund at Oregon State University

How To Stand Out

Three Steps to Recruiting Success for Accounting Students

Current Openings

Kernutt Stokes is growing and we need motivated and driven individuals to help us further our growth. We strive to provide a work environment that is collegial, respectful, and productive. We are committed to the advancement of your career and the advancement of our firm, while also ensuring life balance so our employees can enjoy their well-earned time off. We have a long history of serving Oregon since 1945 through our various locations in Eugene, Corvallis, and Bend.

We have a rich and varied client base: large privately held companies, small family-owned businesses, and high net worth individuals. We specialize in key industries, including beverage, transportation, agriculture, construction, manufacturing, family-owned businesses, and real estate.

We are currently hiring for:

Fall 2024 Full-Time Associates | Eugene, Corvallis, Bend

We are looking for the following students:

- 3.0+ GPA

- Demonstrated leadership ability through sports, clubs, volunteer, or work (including HS!)

- Strong written, oral communication and listening skills

- Demonstrate analytical and problem-solving skills

- Manage resolution of open items timely

- Take ownership of jobs

- Demonstrate good professional judgment

- Client Service – Is courteous, friendly, and professional during client interactions

Graduating June ’23 – August ’24

MajorsAccounting

Obtaining 225 credits does not always require a 5th year of schooling. At Kernutt Stokes, we have a unique program to help students get to work while they complete their remaining credits.

In addition, on average, our first year Assurance/ Tax Staff work 1,490 hours per year. This is roughly 655 fewer hours than 85% of the accounting firms our size in Oregon and all Big 4 firms in Oregon.

Winter 2025 Audit Interns | Eugene, Corvallis, Bend

Join one of Oregon Business magazine’s 2023 100 Best Companies to Work For in Oregon!

This in-person internship allows students in Eugene, Corvallis, and Bend flexible scheduling to work around your class schedule, no travel and a great working environment. This is an excellent introduction into tax for juniors who have not yet taken a tax class or for seniors who want to get hands-on application of the tax they have learned from class.

Our internship is FUN with lots of time to connect with staff over lunch and social activities outside of the office, allowing you to get to know our unique firm and people.

Responsibilities include preparation of individual and business tax returns in multiple industries such as forest products, manufacturing, insurance, high net-worth individuals, health care, transportation, wine and brewing industries, and many more.

Plus, you can earn up six upper-division accounting credits for this internship. Contact Christina Newland to learn how.

Pick an internship that actually prepares you for a career in public accounting and join one of the 100 Best Companies to Work For in Oregon!

Application deadline:October 8, 2023

Graduation DateGraduating June 2025 – September 2027

MajorsAccounting, with a minimum 3.2 GPA

Summer 2025 Audit Interns | Eugene, Corvallis, Bend

During our summer internship, interns get hands-on experience working through the audit process on real clients. You will be assigned two – three audit clients and have the opportunity to conduct the audit from beginning to end with real-time training / coaching from managers and experienced staff! Interns will receive training in the mornings, as a group, on each of the audit areas that they will be expected to complete. In the afternoon, they will apply what they have learned. Once an intern completes one audit, they will get to go through a second audit with coaching as needed. Pick an internship that actually prepares you for a career in public accounting!

Interns also get paid to explore Oregon with our staff and partners during our “Fun Fridays”. Activities have included white water rafting, jetboats, escape rooms, sand rails, go carts and lots of lunches and happy hours, all which make for a very fun time!

Plus, you can earn up six upper-division accounting credits for this internship. Contact Christina Newland to learn how.

The internship starts in early July and runs six weeks, at 40 hours/ week.

Application DeadlineMarch 30, 2024

Graduation DateJune 2025 – September 2027

MajorsAccounting, with a minimum 3.2 GPA

Apply Now

Please submit your resume and cover letter addressed to Christina Newland via Handshake or call Christina at 541-687-1170.

Benefits

Financial Benefits

- Competitive salary and benefits package including compensation for all overtime worked

- A very generous discretionary annual employer 401(k)/profit sharing contribution

- Signing bonus

- CPA licensing bonus

- Employee incentive for new clients

- Reimbursement of continuing education

- 50% reimbursement of individual membership dues in Eugene Country Club, Shadow Hills Country Club, Bend Country Club, and Corvallis Country Club

- Partial reimbursement of engagement in club and civic organizations related to the firm

Career Development Benefits

- Mentoring program

- Commitment to helping you with the job through annual reviews

- Membership in BDO Alliance and access to various resources

- Networking events and social events throughout the year

- Accelerated career advancement with a growing firm

- Opportunity to become partner of the firm

Life Balance Benefits

- An average of 7 weeks’ vacation starting in the first year

- Paid time off

- Less than 1% travel

- Hybrid work from home model

Health & Wellness Benefits

- 100% paid health/dental/vision for employee

- Life insurance

- Employee Assistance Program

- 24 hours a year to use toward community service

- Flexible Spending Account and Health Savings Account