By Brent Laird, CPA and John Mlynczyk, CPA

Qualified Business Income (QBI) is a new tax concept introduced with 2018 tax reform. Many taxpayers are eagerly asking questions about QBI because of the related tax deduction (up to 20%). This provision allows taxpayers who are organized as sole proprietors, single member LLCs, partners in a partnership (including LLCs taxed as partnership), and S Corporation shareholders to benefit from a lower tax rate on their income.

What is QBI? Generally, QBI is ordinary taxable income earned from a trade or business (other than a C Corporation). Taxable income is defined to be net of wages paid to S Corporation shareholders or guaranteed payments to partners in a partnership. For example, if the business earns $200,000 in taxable income before a $50,000 wage payment to the sole shareholder, then the net taxable income of $150,000 is QBI. Furthermore, investment income such as interest, dividends, and capital gains will generally not qualify for QBI.

Eligible taxpayers are divided into two categories when determining limitations for the deduction. The first category is the standard, or default category, which is any trade or business other than a Specified Service Provider (defined below). The standard category of business is fairly broad and would include business such as manufacturers, retailers, and wholesalers for example.

The next second category of taxpayer is known as a “Specified Service Provider” or SSP. SSPs are defined as service providers in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financials services, brokerage services, or any trade or business where the principal asset of the business is the reputation or skill of one or more of its employees. Engineers and architects are specifically excluded from the definition of SSP.

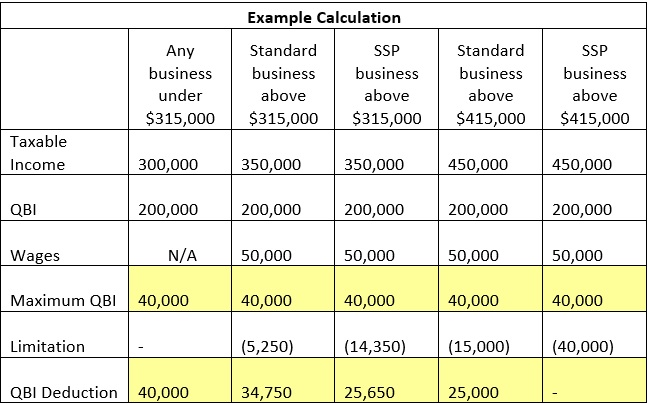

There are three income levels for consideration when calculating the QBI deduction; household taxable income under $315,000, household taxable income between $315,000 and $415,000, and household taxable income in excess of $415,000. Note that these income levels are for married, filing joint taxpayers. These amounts are reduced by one half for single taxpayers, trusts, and estates.

- Household taxable income under $315,000 – the deduction is 20% of QBI for the year.

- Household taxable income between $315,000 and $415,000 – the 20% deduction is limited based upon a combination of 50% employee wages (or 25% of employee wages plus 2.5% of the cost of tangible property in the business), and the amount of household taxable income over $315,000.

- Household taxable income in excess of $415,000 – the 20% deduction is fully limited based upon the combination of 50% of employee wages (or 25% of employee wages plus 2.5% of the cost of tangible property in the business) for non-SSPs. The deduction is completely phased out for Specified Service Providers.

One can see from the example above that calculating the deduction can become very complicated. First, consider the type of business (Standard or SSP). Next, consider the household taxable income of the taxpayer and the related wage and capital limitations. Finally, calculate the limitation in arriving at the QBI deduction. Furthermore, there are still several unknowns regarding the complex definitions included in the legislation. However, our office is working on strategies that may benefit your business now. Please contact our office to discuss some of the early planning opportunities that may be of benefit to you.